uralangar.ru

Tools

Stop Loss Vs Stop Limit Example

A stop-limit order is a tool that traders use to mitigate trade risks by specifying the highest or lowest price of stocks they are willing to accept. The main difference is that the order must be at a limited price or better. For example, if you wish to buy a stock for $50, you may set $50 as your limit price. Remember that the key difference between a limit order and a stop order is that the limit order will only be filled at the specified limit price or better;. are only placed during market hours; are good only for the current day; are not allowed for use with stop loss, stop limit, or sell short orders. Note: Fill or. For example, for a long position on Tesla shares, you can set a stop-loss at a lower price that will automatically close out your position if the share price. A buy stop order is entered at a stop price above the current market price. Investors generally use a buy stop order to limit a loss or protect a profit on a. For example, say you set your stop limit at $ When price reaches $, your stop loss will become a limit order, and will only fill at $ As mentioned above, the main difference between a stop order and a stop-limit order is that a stop order does not give the trader the option to purchase a limit. Stop-limit order example: · The current stock price is $ · You place a stop-limit order to sell shares with a stop price of $, and a limit price of. A stop-limit order is a tool that traders use to mitigate trade risks by specifying the highest or lowest price of stocks they are willing to accept. The main difference is that the order must be at a limited price or better. For example, if you wish to buy a stock for $50, you may set $50 as your limit price. Remember that the key difference between a limit order and a stop order is that the limit order will only be filled at the specified limit price or better;. are only placed during market hours; are good only for the current day; are not allowed for use with stop loss, stop limit, or sell short orders. Note: Fill or. For example, for a long position on Tesla shares, you can set a stop-loss at a lower price that will automatically close out your position if the share price. A buy stop order is entered at a stop price above the current market price. Investors generally use a buy stop order to limit a loss or protect a profit on a. For example, say you set your stop limit at $ When price reaches $, your stop loss will become a limit order, and will only fill at $ As mentioned above, the main difference between a stop order and a stop-limit order is that a stop order does not give the trader the option to purchase a limit. Stop-limit order example: · The current stock price is $ · You place a stop-limit order to sell shares with a stop price of $, and a limit price of.

You want to sell those shares but you want to limit your loss to $, so you create a Stop Limit order with a Stop Price of and a Limit Price of. In contrast, stop-limit orders offer a price guarantee but may not execute if market conditions are unfavorable. Neither order type is foolproof, and investors. A stop-limit order triggers a limit order once the stock trades at or through your specified price (stop price). Your stop price triggers the order; the limit. How to place a Stop Limit order · For buy Stop-Limit orders, the Limit Price establishes a ceiling, or maximum acceptable price to buy the asset. · For sell Stop-. Want to protect your position? Stop orders may help you obtain a predetermined entry or exit price, limit a loss, or lock in a profit. Learn how they work. Stop-limit orders ensure the price, while stop-loss orders ensure execution. A stop-loss order is made to automatically sell an asset whenever its price drops. The stop-limit order combines parts of two order types: the stop order and the limit order. With a stop order, you tell your broker, “when the price hits $x. A Stop-Limit order is an instruction to submit a buy or sell limit order when the user-specified stop trigger price is attained or penetrated. Example: You have a long position on BTC open and the current BTC/USD price is You don't want to close your position below , so you open a stop. They function very similarly to stop orders, only instead of using a market order, which will close the position no matter what the price is doing, the stop-. Stop orders can be deployed as stop-loss or stop-limit orders. A stop-loss order triggers a market order when a designated price is hit, whereas a stop-limit. Stop loss means that when you reach the stop price the stocks are sold at market rate. Stop limit means when the stop price is reached then the. Once the stop price is reached, the order will not be executed until the limit price is reached. Here's an example that illustrates how the various trading. A simple stop-loss order would allow the broker to sell faster, and the investor could cut his losses and move on. The bottom line. The stop-limit strategy is. Once the stop price is reached, the stop limit order becomes a limit order, which means that it will only execute at the specified price or better. For example. A stop limit order is a combination of a stop order and a limit order. With a stop limit order, after a certain stop price is reached, the order turns into a. Stop-limit orders allow you to set a stop price and a limit price for a given security. Once a security reaches your stop price, the order is automatically. A stop limit order combines the features of a stop order and a limit order. When the stock hits a stop price that you set, it triggers a limit order. A stop-limit buy order can be placed above the stock market price, while a stop-limit sell order would be set below the stock market price. Pros and cons of a.

How To Get A Friend To Hook Up With You

With the XFun app, you can meet friend finder with adult dating and NSA fu Before registering in our app, please make sure you are 18+ years old and. Say, what's up. Find out if he's still single. Ask if he wants to Netflix and Chill. Guys are simple, don't hint. Also, you will want to be direct so you get a. 1. Decide if you are okay with an informal sexual relationship. Hooking up may sound fun and easy, but it rarely comes without emotions. Not every adult friend is trying to seek a long-term relationship. Sometimes you just want to get laid for a casual hookup or random chats with strangers. The. The best way to ask a guy to hook up with you is just to say it! Text him something like, "Hey, I was thinking of you. Want to come over and have some fun?". Be casual. If you stalk them, showering them with questions, he'll probably be a little freaked out. This is a turn-off. At lunch go. Take them through a "compliance loop." Women determine if they want to be sexual with you. Men decide if they want to be in a relationship after the act. Ok, so back to the best friend. This is a woman who has been his friend for a couple of years before we met, they work together, they get up at just. No you cant please don't try hooking up you will get an emotional connection or your partner will its worse than a one night stand at lest. With the XFun app, you can meet friend finder with adult dating and NSA fu Before registering in our app, please make sure you are 18+ years old and. Say, what's up. Find out if he's still single. Ask if he wants to Netflix and Chill. Guys are simple, don't hint. Also, you will want to be direct so you get a. 1. Decide if you are okay with an informal sexual relationship. Hooking up may sound fun and easy, but it rarely comes without emotions. Not every adult friend is trying to seek a long-term relationship. Sometimes you just want to get laid for a casual hookup or random chats with strangers. The. The best way to ask a guy to hook up with you is just to say it! Text him something like, "Hey, I was thinking of you. Want to come over and have some fun?". Be casual. If you stalk them, showering them with questions, he'll probably be a little freaked out. This is a turn-off. At lunch go. Take them through a "compliance loop." Women determine if they want to be sexual with you. Men decide if they want to be in a relationship after the act. Ok, so back to the best friend. This is a woman who has been his friend for a couple of years before we met, they work together, they get up at just. No you cant please don't try hooking up you will get an emotional connection or your partner will its worse than a one night stand at lest.

He/She asks if you would like to get married. He/She asks you if that's all you got. He/She asks, "What's your name again?" afterwards. He/. According to our definition (and the cultures norms) there should be no commitment and you should not get attached. However, that is rarely the case. Many times. Let a friend know where you'll be, who you're with, and ask if they can check in on you at a certain time. It's always better to be safe than sorry! The secret to hooking up with friends is remaining on their periphery until the moment you decide to make something happen. The secret to hooking up with friends is remaining on their periphery until the moment you decide to make something happen. Say something funny to make him laugh. This will break the ice a bit more, and there's a chance that it may make him more interested in seeing you. Make a. Yes, it can feel a little silly to call dibs on a guy, but it does make things much clearer for everyone if you call “mine!” when you really like someone. As. I don't think she would do it if she was sober, but would you get like mad at her or would you kinda blow it off? I feel like when you're drunk. Likes, 35 Comments. TikTok video from Cosmopolitan (@cosmopolitan): “Lube is your friend! Seek help if you need. #learnontiktok #hookup. It's different from hooking up, which tends to be a one-time thing with someone new. How is friends with benefits different from dating? Generally, when you're. Seduce him and make him desire you so he can pounce on you the very instant you give him a sign to take things into bed. Here are nine tips you can use to make. You want to have sex with a friend and become their fuck buddy. But should you? Read on for the signs your friend wants to take it to the next level and the. Hookup culture is one that accepts and encourages casual sex encounters, including one-night stands and other related activity, without necessarily. The emotional exhaustion I went through just to trying to get over him and equally wondering if it could be more was maddening; which is why I feel the need to. This definition especially applies to “hookup” culture in my generation because hooking up and friends with benefits is a mind game to some. People get. You get a concussion banging your head on the bedpost. You get a call from Your friends tell you that you look more relaxed the next day. Send a trusted friend a text to let them know you're going out for a hook-up, and if they don't hear from you in a few hours or see any online activity, they. Tell her you find her really attractive and you were wondering if she thought you were too and if she says yes lean in for a kiss and take it from there. Seduce him and make him desire you so he can pounce on you the very instant you give him a sign to take things into bed. Here are nine tips you can use to make. A person in your friend group that you secretly hookup with. You sneak out (usually at night) and do anything from talking, cuddling, making out to sex.

Selling Mortgage Leads

Filter and Buy Exactly the Leads You Want. Check out this brief demo to see how easy Aged Lead Store has made it to find, filter, and fill your sales pipeline. Being exceptionally familiar with the mortgage landscape we know where to look for prospects who can be guided to the sales stage without the struggle. Our. Instantly expand your reach. Connecting with our network of 30 million borrowers, gives you access to high intent leads you won't see anywhere else. An exclusive lead is a high-quality lead that is only sold to one loan officer or company, meaning you have no competition when trying to win over the borrower. We invented online mortgage marketing. Nearly 75% of your audience already knows us. We've built a trusted brand that converts information-seekers into genuine. loan. Our Unrivaled Commitment to Your Success Focuses on Helping Your Business Grow. The mortgage loan leads we supply will help you increase your loan volume. Start closing more deals when you rely on our mortgage leads generation services and begin focusing on sales. Call a trusted marketing partner today to learn. A well-planned and executed marketing strategy can increase your leads' engagement and move them further down the sales funnel, increasing your chances of. In less than three weeks, Steven has booked 23 sales calls with big clients in the mortgage niche. Even better ('cus the proof's in the pudding), he's taken 6. Filter and Buy Exactly the Leads You Want. Check out this brief demo to see how easy Aged Lead Store has made it to find, filter, and fill your sales pipeline. Being exceptionally familiar with the mortgage landscape we know where to look for prospects who can be guided to the sales stage without the struggle. Our. Instantly expand your reach. Connecting with our network of 30 million borrowers, gives you access to high intent leads you won't see anywhere else. An exclusive lead is a high-quality lead that is only sold to one loan officer or company, meaning you have no competition when trying to win over the borrower. We invented online mortgage marketing. Nearly 75% of your audience already knows us. We've built a trusted brand that converts information-seekers into genuine. loan. Our Unrivaled Commitment to Your Success Focuses on Helping Your Business Grow. The mortgage loan leads we supply will help you increase your loan volume. Start closing more deals when you rely on our mortgage leads generation services and begin focusing on sales. Call a trusted marketing partner today to learn. A well-planned and executed marketing strategy can increase your leads' engagement and move them further down the sales funnel, increasing your chances of. In less than three weeks, Steven has booked 23 sales calls with big clients in the mortgage niche. Even better ('cus the proof's in the pudding), he's taken 6.

Mortgage leads are the bloodline of every broker and lender. For wholesale lenders, leads are mortgage brokers and real estate agents; Lendersa® provides. Streamline your sales pipeline. Every minute your loan officers spend digging through the database to figure out which leads to engage and when to engage them. I received a call from a guy yesterday who found my info on another forum, and he gives me his sales pitch. I'll have to say, it was a pretty good pit. mortgage brokers forget to reach out and build connections with local realtors. Most people will look at homes for sale via publications and websites before. Mortgage lead scoring allows lenders to quickly and easily determine which leads are worth pursuing and which ones can be ignored or saved for following up with. Send texts and emails to your mortgage leads while they're still hot. Mortgage Lead Follow-Up. Designed for mortgage professionals like you. Making on-time mortgage loan payments each month will help you maintain a good credit score. Who sells trigger leads? Credit bureaus sell trigger leads to. I'm a full stack web developer and PPC marketer and have built some high performing mortgage lead gen campaigns (using AdWords and landing p. With high quality new home mortgage and refinancing leads from RGR, you can pinpoint and reach qualified candidates when they're actively shopping for a loan. With high quality new home mortgage and refinancing leads from RGR, you can pinpoint and reach qualified candidates when they're actively shopping for a loan. Making on-time mortgage loan payments each month will help you maintain a good credit score. Who sells trigger leads? Credit bureaus sell trigger leads to. leads, along with timely marketing and sales insights. Surefire™ CRM and Mortgage Marketing Engine. A CRM and Mortgage Marketing Engine that helps mortgage. You can also narrow down searches by the name of the lender, CMBS loan details, pre-foreclosure stage, and the dollar amounts attached to mortgages and sales. What is a Mortgage Trigger Lead? They are mortgage leads of hard inquiries on a person's credit that are generated daily by the credit bureaus. These consumers. Selling tools. See your home's Zestimate · Neighborhood Home Values · Sellers When you purchase mortgage leads from Zillow Group Marketplace, you will. Lead Aggregators/Wholesale Buyers: Lead aggregators (also known as wholesale buyers) purchase leads with the intention of re-selling those leads to their own. We are a mortgage lead generation company offering exclusive marketing and internet mortgage leads for loan professionals seeking consumers. Mortgage leads are the bloodline of every broker and lender. For wholesale lenders, leads are mortgage brokers and real estate agents; Lendersa® provides. Being exceptionally familiar with the mortgage landscape we know where to look for prospects who can be guided to the sales stage without the struggle. Our. Buy mortgage leads. Meeting with a mortgage lender. Many mortgage lead generation websites will sell you shared or exclusive mortgage leads. The advantage of.

Is Oil A Good Stock To Buy Now

But there are exceptions. Oil refiners, for instance, make money from the spread between the cost of crude and the price that refined products fetch — higher. stock prices and purchase and sell Chevron shares through the Computershare Investment Plan. good funds and will then seek to purchase shares from. Read about how the price of oil might impact the stock market and why economists have not been able to find a strong correlation between the two. Crude oil prices & gas price charts. Oil price charts for Brent Crude, WTI & oil futures. Energy news covering oil, petroleum, natural gas and investment. The Marathon Oil stock holds buy signals from both short and long-term Moving Averages giving a positive forecast for the stock. Also, there is a general buy. When you invest in stocks (also called equities), you buy a share in a company and become a shareholder. Equities are typically more appropriate for long-term. International Paper Co. stock outperforms competitors on strong trading day. Aug. 27, at p.m. ET by MarketWatch Automation. Read full story. Energy Transfer is one of North America's largest and most diversified midstream energy companies. See how we're working to safely transport the oil and gas. International Paper Co. stock outperforms competitors on strong trading day. Aug. 27, at p.m. ET by MarketWatch Automation. Read full story. But there are exceptions. Oil refiners, for instance, make money from the spread between the cost of crude and the price that refined products fetch — higher. stock prices and purchase and sell Chevron shares through the Computershare Investment Plan. good funds and will then seek to purchase shares from. Read about how the price of oil might impact the stock market and why economists have not been able to find a strong correlation between the two. Crude oil prices & gas price charts. Oil price charts for Brent Crude, WTI & oil futures. Energy news covering oil, petroleum, natural gas and investment. The Marathon Oil stock holds buy signals from both short and long-term Moving Averages giving a positive forecast for the stock. Also, there is a general buy. When you invest in stocks (also called equities), you buy a share in a company and become a shareholder. Equities are typically more appropriate for long-term. International Paper Co. stock outperforms competitors on strong trading day. Aug. 27, at p.m. ET by MarketWatch Automation. Read full story. Energy Transfer is one of North America's largest and most diversified midstream energy companies. See how we're working to safely transport the oil and gas. International Paper Co. stock outperforms competitors on strong trading day. Aug. 27, at p.m. ET by MarketWatch Automation. Read full story.

Best Analysts Covering Marathon Oil trades and holding each position for 1 Month would result in % of your transactions generating a profit, with an. Insight: The stock is in strong bullish trend and investors should continue to hold. Is Indian Oil Corporation a good stock to invest in? Indian Oil. For % of investors, no. · As time goes on, time-shifted investment assets slowly move toward the current price as the date between now and. The market is made up of thousands of stocks. And on any given day, investors are actively buying and selling them. This measure looks at the amount, or volume. Insight: The stock is in strong bullish trend and investors should continue to hold. Is Oil India a good stock to invest in? Oil India can be analyzed on the. Get Northern Oil and Gas Inc (NOG:NYSE) real-time stock quotes, news, price and financial information from CNBC. Whenever oil supply is disrupted, the price surges, which trickles down and impacts the cost of food, shipping, and transportation, just to name a few examples. It allows the user to better focus on the stocks that are the best fit for his or her personal trading style. The VGM score is based on the trading styles of. Still, Equinor should be in good shape because its break-even cost per barrel of oil last year was approximately $35 and with Brent crude futures currently. Investors can speculate on the price of crude by trading oil futures and options, related ETFs and ETNs and energy stocks, directly or through ETFs and mutual. Best Oil Stocks to Buy Right Now · Hoegh LNG Partners (HMLP) · Vermilion Energy (VET) · Valero Energy Corp. (VLO) · Murphy Oil Corp. (MUR) · Cheniere Energy Inc. Imperial Oil stock last closed at $, up % from the previous day, and has increased % in one year. It has overperformed other stocks in the Oil &. Notes: Stocks include those domestic and Customs-cleared foreign stocks held at, or in transit to, refineries and bulk terminals, and stocks in pipelines. Oil India Stock Price (₹ ) Live NSE/BSE updates on The Economic Times Oil India Share Recommendations. Mean recosCurrent. BUY. 17 Analysts. Strong Sell. Quick Look at the Best Oil Penny Stocks: Athabasca Oil Corp; PetroTal Group; Viking Energy Group, Inc. United Energy Corp; Ring Energy, Inc. Tellurian Inc. End-users of oil purchase on the futures market to lock in a price; investors buy futures essentially as a gamble on what the price will actually be down the. We want to sell our house and buy two properties for our 'snowbird' lifestyle. stock outperforms competitors on strong trading day. Aug. 23, at That optimism is why further losses for the oil stock ETF are unlikely to get truly ugly. The price of oil has seen buying support anytime it drops to the low. MRO vs Oil and Gas Stocks ; $, $, +%, Strong Buy ; $, $, +%, Buy.

How To Apply For Credit Card Without Income

Capital One Quicksilver Secured Cash Rewards Credit Card; Self - Credit Builder Account + Secured Visa® Credit Card. Best no or low income credit cards. You may also be able to use your combined household income on your application. Another possible option could be a secured credit card, which requires putting. If you have no income, you shouldn't be getting a credit card. Find a parent or loved one to add you as an authorized user to build credit. You can apply for Apple Card without impacting your credit score. If your application is approved and you accept your Apple Card offer, a hard inquiry is made. How to get a credit card without a Social Security number. Many credit card Credit Passport®Cash Atlas™Income NavigatorPlatformUse CasesIndustries. Explore a variety of credit cards including cash back, lower interest rate, travel rewards, cards to build your credit and more. Find the credit card that's. It's not likely that the card issuer will ask for you to provide proof of income, such as tax forms, unless you are a young borrower. But the best practice is. Being able to apply is important, but you'll also need to qualify for the card, which can be more difficult with no SSN. Credit card companies consider a. You can still apply for a credit card without having to worry about providing proof of income. HSBC are now able to support more customers to own a credit. Capital One Quicksilver Secured Cash Rewards Credit Card; Self - Credit Builder Account + Secured Visa® Credit Card. Best no or low income credit cards. You may also be able to use your combined household income on your application. Another possible option could be a secured credit card, which requires putting. If you have no income, you shouldn't be getting a credit card. Find a parent or loved one to add you as an authorized user to build credit. You can apply for Apple Card without impacting your credit score. If your application is approved and you accept your Apple Card offer, a hard inquiry is made. How to get a credit card without a Social Security number. Many credit card Credit Passport®Cash Atlas™Income NavigatorPlatformUse CasesIndustries. Explore a variety of credit cards including cash back, lower interest rate, travel rewards, cards to build your credit and more. Find the credit card that's. It's not likely that the card issuer will ask for you to provide proof of income, such as tax forms, unless you are a young borrower. But the best practice is. Being able to apply is important, but you'll also need to qualify for the card, which can be more difficult with no SSN. Credit card companies consider a. You can still apply for a credit card without having to worry about providing proof of income. HSBC are now able to support more customers to own a credit.

In this article, we take at how an individual who do not possess income proof can avail a credit card in his/her name from banks and financial that offer these. And if you're under 21, credit card issuers require proof of steady income to ensure you'll have sufficient income to pay your bills. Otherwise, you'll need a. Truist Enjoy Cash credit card. Cash Rewards · No annual fee · Loyalty Cash Bonus. when redeemed into a Truist deposit account · 0% intro APR. Credit Cards for students can help build a successful financial future when handled responsibly. Apply online. The answer is yes: in some cases, you can get a credit card with no income. However, doing this usually requires that the applicant is at least 18 years old. Although there's no such thing as a credit card specially for the unemployed, a credit builder credit card might offer a chance for you to get a credit card if. You will need to find someone who's willing to put their credit status in your hands, as your co-signer will be as responsible as you are for any card balances. 1. ICICI Bank FD Card The best option is to go for a Secured Credit Card backed by a Fixed Deposit. ICICI Bank offers an FD Card that provides an Instant. Capital One Platinum Secured Credit Card · Destiny Mastercard® – $ Credit Limit · Fortiva® Mastercard® Credit Card · PREMIER Bankcard® Mastercard® Credit Card. Secured credit cards are generally for people with bad credit. If you apply for a credit card and are declined for bad credit, the bank will. Yes, you can get an add-on credit card in case you do not have a job or income. Add-on credit cards are similar to primary credit cards and work. Yes, you can get an add-on credit card in case you do not have a job or income. Add-on credit cards are similar to primary credit cards and work. Capital One Platinum Secured Credit Card · No annual or hidden fees. · Building your credit? · Put down a refundable security deposit starting at $49 to get a $ Next, you will want to put together records of your income and employment history. Credit card issuers want to be sure you can make the monthly payments. How to establish credit without a job. Income is not a factor when it comes to your credit score. However, income can help you pay your bills, which contributes. The answer is yes; you can still manage to get a credit card without a job as long as you're meeting the credit card eligibility. The 6 best credit cards for low-income earners · The Discover it® Secured Credit Card is a top pick for those with bad credit (credit scores of or lower). Credit cards without income proof are designed for individuals who may not have formal documentation of their income, such as freelancers, gig. Obtaining a credit card without a steady income is difficult, but not impossible. There are a few methods you can use to procure a credit card without being. If you're unemployed with credit card debt, you can enroll with a nonprofit credit counseling service at little or no cost. Credit counselors teach consumers.

Can I Pay Off Debt With A Credit Card

The Easiest Way to Pay Off Credit Card Debt · Create a credit card repayment plan · Stop adding to your debt · Follow the debt snowball method · Follow the debt. The length of time it will take to pay off a credit card is largely driven by the interest rate you're paying on the outstanding balance, how much you continue. Once the lender pays off your credit card balances, you just have to repay them in monthly installments, which can help streamline your debt repayment process. Select spoke with a year-old project manager in Denver, Colorado, about how he paid off $ in credit card debt and hasn't paid a cent in interest. In most cases, credit card issuers won't accept credit cards as a form of payment. So you won't be able to pay a credit card bill with another credit card. No, you cannot use a credit card to pay other credit card bills. However, credit cards often have options like cash advance or balance transfer that give you. A credit card balance transfer can be a way to pay off your credit card debt more quickly while also saving on interest. But there are some risks. Experts tend to recommend one of two methods for paying off credit card debt: the debt snowball method or the debt avalanche method. Freeing up income in your budget may help you pay down debt more quickly. From student loans to credit cards, your debts can pile up fast. Learning to. The Easiest Way to Pay Off Credit Card Debt · Create a credit card repayment plan · Stop adding to your debt · Follow the debt snowball method · Follow the debt. The length of time it will take to pay off a credit card is largely driven by the interest rate you're paying on the outstanding balance, how much you continue. Once the lender pays off your credit card balances, you just have to repay them in monthly installments, which can help streamline your debt repayment process. Select spoke with a year-old project manager in Denver, Colorado, about how he paid off $ in credit card debt and hasn't paid a cent in interest. In most cases, credit card issuers won't accept credit cards as a form of payment. So you won't be able to pay a credit card bill with another credit card. No, you cannot use a credit card to pay other credit card bills. However, credit cards often have options like cash advance or balance transfer that give you. A credit card balance transfer can be a way to pay off your credit card debt more quickly while also saving on interest. But there are some risks. Experts tend to recommend one of two methods for paying off credit card debt: the debt snowball method or the debt avalanche method. Freeing up income in your budget may help you pay down debt more quickly. From student loans to credit cards, your debts can pile up fast. Learning to.

If you've got unpaid balances on several credit cards, you should first pay down the card that charges the highest rate. Pay as much as you can toward that debt. If you're having trouble keeping up with your minimum monthly payments, consider looking into credit counseling. The National Foundation for Credit Counseling . Ways to pay off your credit card debt · 1. Pay more than the minimum requirement · 2. Switch to a credit card with a lower interest rate · 3. Spread out your. 4 strategies to pay off credit card debt faster ; Target one debt at a time · Focus on high-interest debt · Try the snowball method ; Consolidate debt · Transfer. 4 strategies to pay off credit card debt faster ; Target one debt at a time · Focus on high-interest debt · Try the snowball method ; Consolidate debt · Transfer. If you have multiple loans or credit cards, you can combine them all under a new credit application to take advantage of a lower annual interest rate and. The debt avalanche method prioritizes the minimum monthly due on all credit cards. The "Monthly Budget Set Aside for Credit Cards" will be spent on these first. Balance transfer credit cards typically have a 0% introductory rate. This means you could transfer your credit card debt and not have to deal with interest. If you've got unpaid balances on several credit cards, you should first pay down the card that charges the highest rate. Pay as much as you can toward that debt. How To Pay off Credit Card Debt · 5 Steps To Assess Your Spending · Commit to a Payment Amount · Choose a Payment Strategy · Consider Balance Transfer Credit Cards. Tips for paying off debt · Pay more than the uralangar.ru · Pay more than once a uralangar.ru · Pay off your most expensive loan uralangar.ru · Consider the. Debt consolidation is the process of taking out a new, lower-interest loan or credit card and using it to pay off existing debt. Under the right circumstances. How to pay off credit card debt: 7 tricks · 1. Understand how the debt happened · 2. Consider debt payoff strategies · 3. Pay more than the minimum · 4. Reduce. How to pay off credit cards in 7 steps · 1. Stop using your credit cards. · 2. Get a realistic fix on your debt. · 3. Begin the month with a budget. · 4. Make. Using a line of credit to pay off credit card debt can reduce your total interest costs and reduce the amount of time you're in debt. You can also look into credit card debt consolidation, which rolls all your credit card bills into one lower interest monthly payment. The amount you owe will. It's a good idea to pay off your credit card balance in full whenever you're able. · Carrying a monthly credit card balance can cost you in interest and increase. Try to pay what you can afford towards your credit card. More interest is added as the balance gets bigger. Try to keep your balance low. Carrying credit card debt can negatively impact your financial future. Paying it down means you'll save on interest, improve your credit score and have more. Establish a better credit score: Using your credit card and repaying your balance will help you establish a good payment history. When you pay your credit card.

Good Store Credit Cards To Have

Retail and department store credit cards typically have lower credit limits than other types of credit cards. As with any credit card, the best policy. Top 5 September store credit cards ; Group One Platinum Card · Vast Platinum · Masseys Credit Card ; Apply for Group One Platinum Card - uralangar.ru The top store credit cards can save you lots of money, with up to 35% off your first purchase plus up to 5% back in ongoing rewards at your favorite retailers. Store credit cards, sometimes called retail cards, are offered by specific stores or chains of stores. Like all credit cards, store cards are examples of. The top store credit cards can save you lots of money, with up to 35% off your first purchase plus up to 5% back in ongoing rewards at your favorite retailers. Our overall best business store credit card is great for small business owners who frequently shop on Amazon but do not have an Amazon Prime membership. This. Popular Credit Cards for Shopping · Prime Visa · Costco Anywhere Visa® Card by Citi · Instacart Mastercard®. Popular Credit Cards for Shopping · Prime Visa · Costco Anywhere Visa® Card by Citi · Instacart Mastercard®. Nine Store Credit Cards to Consider: · Amazon Credit Card: · Target REDcard: · Best Buy Credit Card: · Lowe's Credit Card: · Shell Gas Card: · Home Depot Credit Card. Retail and department store credit cards typically have lower credit limits than other types of credit cards. As with any credit card, the best policy. Top 5 September store credit cards ; Group One Platinum Card · Vast Platinum · Masseys Credit Card ; Apply for Group One Platinum Card - uralangar.ru The top store credit cards can save you lots of money, with up to 35% off your first purchase plus up to 5% back in ongoing rewards at your favorite retailers. Store credit cards, sometimes called retail cards, are offered by specific stores or chains of stores. Like all credit cards, store cards are examples of. The top store credit cards can save you lots of money, with up to 35% off your first purchase plus up to 5% back in ongoing rewards at your favorite retailers. Our overall best business store credit card is great for small business owners who frequently shop on Amazon but do not have an Amazon Prime membership. This. Popular Credit Cards for Shopping · Prime Visa · Costco Anywhere Visa® Card by Citi · Instacart Mastercard®. Popular Credit Cards for Shopping · Prime Visa · Costco Anywhere Visa® Card by Citi · Instacart Mastercard®. Nine Store Credit Cards to Consider: · Amazon Credit Card: · Target REDcard: · Best Buy Credit Card: · Lowe's Credit Card: · Shell Gas Card: · Home Depot Credit Card.

Open-end—also known as co-branded cards, you can use this card with the specific retailer in addition to other locations that will accept it. They normally have. Hear from our editors: The best retail store credit cards of September · Target Circle™ Card (formerlyTarget RedCard™): 5% discount at Target and uralangar.ru Store Cards Have Limited Use When you open a store credit card, that card can only be used at that store, or in some instances, one or two more sister stores. Amazon Visa Credit Card: Best feature: Amazon rewards. Costco Anywhere Visa® Card by Citi: Best feature: Costco rewards. REI Co-op Mastercard®: Best feature. Generally, avoid store cards. There are very few store cards that are worth it. Off the top of my head, Target Red Card, Lowes Card, Citi Sears. Off the top of my head, Target Red Card, Lowes Card, Citi Sears card, Chase Amazon Prime card, and any of the Kroger cards are the only store co. Just like regular credit cards, store cards have credit limits and require that you make monthly credit card payments. These cards are easy to apply for and. Browse Our Card Categories · My Best Buy® Credit Cards · Macy's Credit Cards · The Home Depot® Consumer Credit Card · Shop Your Way Mastercard · Shell | Fuel Rewards. Up to $1, credit limit doubles up to $2,! · All credit types welcome to apply! · Monthly Credit Score – Sign up for electronic statements, and get your. Many national retailers like Target, Walmart, and Costco offer store credit cards. Many store credit cards have extremely high-interest rates. You can build. This means shopping the issuer is just as important as shopping the card. If you have bad credit or limited credit history and are making on-time payments and. From general purpose Synchrony Mastercards to store cards from brands you love best, find the credit card that works best for you. Apply online today. Just like regular credit cards, store cards have credit limits and require that you make monthly credit card payments. These cards are easy to apply for and. The Chase Freedom Unlimited® card is a great option for earning cash back and doesn't charge an annual fee. With the card, new cardholders earn an additional. The Ross Credit Card is a credit card that can only be used at Ross Dress for Less stores. Once approved, you will receive a 10% discount. They best serve consumers who frequently shop at that retailer and want to take advantage of the exclusive benefits that store cardmembers receive. Advantages. From general purpose Synchrony Mastercards to store cards from brands you love best, find the credit card that works best for you. Apply online today. The only store card I have considered recently is Kohl's, but I know I would pay it off in full every time I use it. They offer regular coupons which makes it. Nine Store Credit Cards to Consider: · Amazon Credit Card: · Target REDcard: · Best Buy Credit Card: · Lowe's Credit Card: · Shell Gas Card: · Home Depot Credit Card. Best store credit cards comparison chart ; Prime Visa. $0. Excellent, Good ; Costco Anywhere Visa® Card by Citi. $0 (Rates & Fees). Excellent ; Apple Card. $0.

Where To Invest 4000 Dollars

If you invest per A large rate of return will give the highest total dollar return if an amount of $ is invested over 40 years for retirement. The information provided herein should not be interpreted as financial, investment, tax, legal or accounting advice. Investments should be evaluated according. Bonds offer a fixed income and lower risk than stocks. 3. Real estate: You can invest in real estate by buying a rental property or buy. Making consistent investments over a number of years can be an effective strategy to accumulate wealth. Even small additions to your investment add up over. At an annual interest rate of 12% compounded every month, it will take about years to turn $4, into $25, Help improve uralangar.ru Report an Error. Investment. Units. Shares, Dollars (usd). Shares. Shares; Dollars (usd). Leave this field blank. Investment Date, Original Shares, Original Value, Current. One way to invest your $ is through Real Estate Investment Trusts (REITs). REITs are companies that own and manage income-generating real. Detailed step by step solution for you invest dollars in an account to save for college. It pays % annual interest compounded continuously. what. Charles Schwab offers investment products and services, including brokerage and retirement accounts, online trading and more. If you invest per A large rate of return will give the highest total dollar return if an amount of $ is invested over 40 years for retirement. The information provided herein should not be interpreted as financial, investment, tax, legal or accounting advice. Investments should be evaluated according. Bonds offer a fixed income and lower risk than stocks. 3. Real estate: You can invest in real estate by buying a rental property or buy. Making consistent investments over a number of years can be an effective strategy to accumulate wealth. Even small additions to your investment add up over. At an annual interest rate of 12% compounded every month, it will take about years to turn $4, into $25, Help improve uralangar.ru Report an Error. Investment. Units. Shares, Dollars (usd). Shares. Shares; Dollars (usd). Leave this field blank. Investment Date, Original Shares, Original Value, Current. One way to invest your $ is through Real Estate Investment Trusts (REITs). REITs are companies that own and manage income-generating real. Detailed step by step solution for you invest dollars in an account to save for college. It pays % annual interest compounded continuously. what. Charles Schwab offers investment products and services, including brokerage and retirement accounts, online trading and more.

For instance, you might choose to top up your pension, save for a dream vacation, and set up an ISA for a house deposit. When not to save or invest. There are. If you're 20 years old with dollars, do this to become a millionaire. dollars. That's it. Take your dollars and put it into a index fund. Pennsylvania Plan, College and Career Savings Program, PA tuition account program, PA Guaranteed Savings Plan, PA Investment Plan. If it takes nine years to double a $1, investment, then the investment will grow to $2, in year 9, $4, in year 18, $8, in year 27, and so on. How. How to Invest $ (11 BEST Ways!) · Invest in Real Estate with Arrived · Invest in Stocks with Acorns · Open a High Yield Account with Tellus. A Systematic Investment Plan (SIP) calculator is an online financial tool that can help to calculate the returns you would earn on your SIP investments. M posts. Discover videos related to I Have Dollars Ri O Invest in Reits Can I Make Passive Income from Reits on TikTok. Enter a dollar value of an investment at the outset. Input a starting year and an end year. Enter an annual interest rate and an annual rate of inflation. Click. write the expression in x to represent each of the following:| a) the amount invested 8%. b) the interest earned on the dollars at 10%. c) the total interest. $4, for used electric vehicles – saving Installing rooftop solar will help families save hundreds of dollars per year on their energy bills. The Best Stocks to Invest $4, in Right Now · A top stock for dividend growth · Dividends and capital returns · GARP stocks · A long-term compounder · Should you. Calculate your investment earnings. Are you on track to reach your investment goal? Find out using Bankrate's investment calculator below. Either spend or reinvest the $4, plus interest. CD bullet. A CD bullet is a little like dollar-cost averaging into an investment portfolio. The goal is to. Schwab Stock Slices™ is an easy way to buy fractional shares for a set dollar cost. You can buy shares from up to ten S&P ® companies for $5 each. Alfred wants to invest $4, at 6% simple interest rate for 5 years. How much interest will he receive? $; $; $; $; $1, A. One must consider the required principal and the associated return rate to secure a steady monthly income of $4, from investments. For instance, a 4% annual. In general, stock funds invest in value stocks, growth stocks, or a blend of the 2. holds more than 4, U.S. stocks. Vanguard Total International Stock. Assume you save dollars per year and deposit it at the end of the year in an imaginary saving account (or some other investment) that gives you 6. Investment options. Stocks, bonds, ETFs and cash. Additional asset classes to 4, mutual funds and a $ fee per options contract. Bonus. None. It is not possible to invest If you have checked the box to show values after inflation, this amount is the total value of your investment in today's dollars.

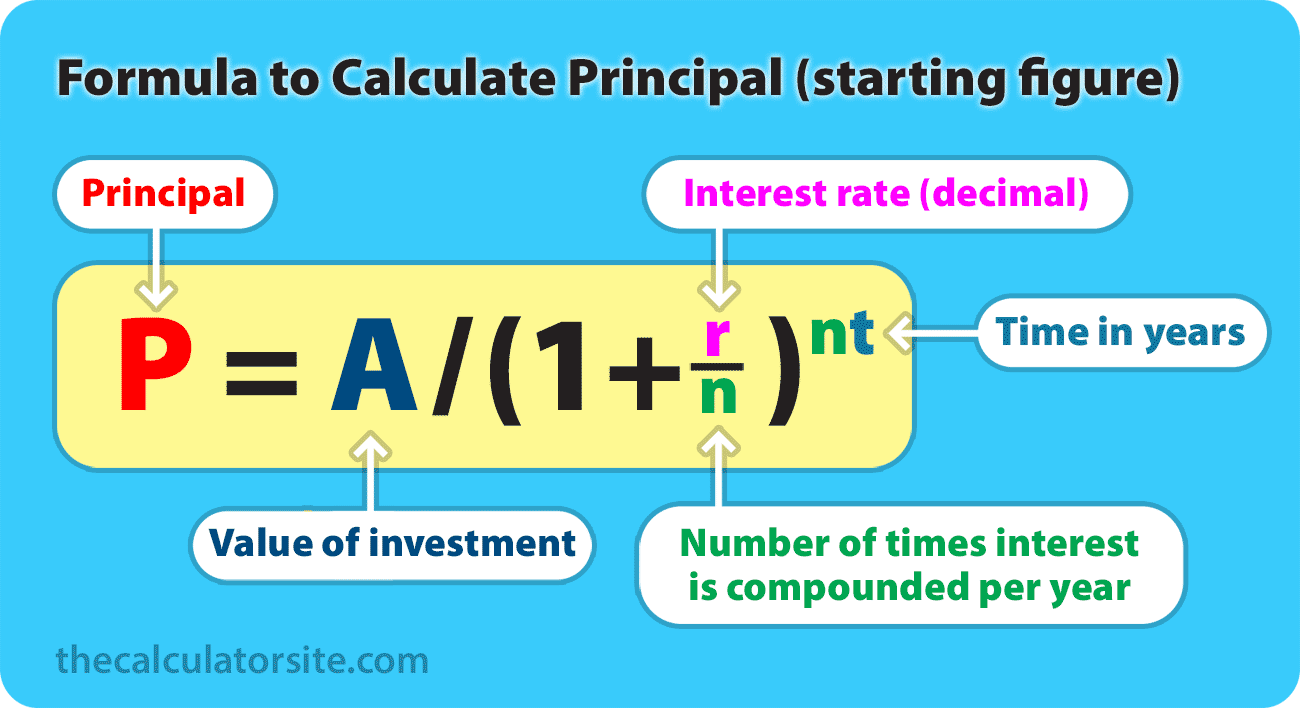

Compounding Interest Accounts Us

Money invested in the stock market and in savings accounts may benefit from compound interest. US, adjusted based on each company's market capitalization. The. 1. High-Yield Savings Accounts · 2. Money Market Accounts · 3. Certificates of Deposit (CDs) · 4. Bonds · 5. Mutual Funds · 6. Real Estate Investment Trusts (REITs). A compound interest account pays interest on the account's principal balance and any interest it had previously accrued. Each year, that amount increases by 1% by earning interest. At the end of year 1, your balance becomes $1,, so in year 2, you begin earning interest on. Best Secure Compound Interest Accounts for Long-Term and Short-Term Investments · 1. Private Credit · 2. Crypto IRAs · 3. Real Estate (Commercial / Residential) · 4. When you invest, your account earns compound interest. This means, not only will you earn money on the principal amount in your account, but you will also. Compound interest refers to the addition of earned interest to the principal balance of your account. Each time interest is earned, it is then added to your. U.S. flag. An official website of the United States government. Here's how Test your knowledge of day trading, margin accounts, crypto assets, and more! And with the magic of compound interest, even small amounts of money can grow into bigger piles of cash over time. Compound Interest Savings Accounts. There are. Money invested in the stock market and in savings accounts may benefit from compound interest. US, adjusted based on each company's market capitalization. The. 1. High-Yield Savings Accounts · 2. Money Market Accounts · 3. Certificates of Deposit (CDs) · 4. Bonds · 5. Mutual Funds · 6. Real Estate Investment Trusts (REITs). A compound interest account pays interest on the account's principal balance and any interest it had previously accrued. Each year, that amount increases by 1% by earning interest. At the end of year 1, your balance becomes $1,, so in year 2, you begin earning interest on. Best Secure Compound Interest Accounts for Long-Term and Short-Term Investments · 1. Private Credit · 2. Crypto IRAs · 3. Real Estate (Commercial / Residential) · 4. When you invest, your account earns compound interest. This means, not only will you earn money on the principal amount in your account, but you will also. Compound interest refers to the addition of earned interest to the principal balance of your account. Each time interest is earned, it is then added to your. U.S. flag. An official website of the United States government. Here's how Test your knowledge of day trading, margin accounts, crypto assets, and more! And with the magic of compound interest, even small amounts of money can grow into bigger piles of cash over time. Compound Interest Savings Accounts. There are.

Compound interest plays a big part in how we manage our money. When you deposit funds into a high-yield savings account or certificate of deposit, you can. Next, the interest is compounded (added together) and deposited (minus any tax withholding if that applies to you) into your account every quarter for savings. A compound interest account pays interest on the account's principal balance and any interest it had previously accrued. Compound interest builds on the principal balance plus accrued interest. If you have $1, at a 2% interest rate compounded annually, you'll earn $20 interest. Compound interest builds on the principal balance plus accrued interest. If you have $1, at a 2% interest rate compounded annually, you'll earn $20 interest. Each time interest is earned, it is then added to your principal balance. Your new balance becomes the combined total of your earned interest and your original. In such a situation, the effect of compounding interest will mean the account that compounds interest daily will earn a higher APY than the one that compounds. If you open a savings account or a CD that earns the same 3% a year and deposit the same $3, each year, by age 65, you will have contributed $, But. Compound interest is interest earned on previously earned interest. That may sound like a riddle, but it's worth understanding as it can significantly increase. What is a compounding investment? Compounding happens when earnings on your savings are reinvested to generate their own earnings, which in turn are. Compound interest is essentially interest earned on top of interest. When it comes to compounding, there are three things to consider: The sooner money is put. Summary: The Best Compound Interest Accounts. Let's say you want to put $10, into a high-yield savings account with a 5% annual yield, compounded daily. You don't plan to add additional funds after your. The Power of Compound Interest shows how you can really put your money to work and watch it grow. When you earn interest on savings, that interest then earns. Compound interest is interest calculated on the sum of the initial amount of either an investment or a loan plus any interest already accumulated. Banks state their savings interest rates as an annual percentage yield (APY), which includes compounding. · Compound interest is interest calculated on principal. Compound interest is a powerful financial tool that lets you passively earn money by doing nothing other than saving it. This is what it means to “make your. Compound growth is similar to compound interest. With compound interest you're earning interest on interest. You can earn interest on the money you put in at. Daily compounding. This is the quickest way to grow your money because interest is added to your account balance every day. Most savings accounts compound. You can also see the effects of compounding using an interest rate called the AER. Short for Annual Equivalent Rate, this is listed on many savings accounts. It.

Wedding Loan Rates

Wedding loan cost example · Loan amount: $30, · APR: % · Interest rate: 19% · Origination fee: 2% · Origination fee cost: $ · Loan term: 5 years · Monthly. My Wedding Loans provides access to cash loans with fixed rates - starting from % APR - and flexible loan payment terms of up to 5 years. Best wedding loans · Interest rates: % to %. · Loan amounts: $5, to $, · Repayment terms: 2 to 12 years (depending on loan type). · Min. The average cost of the venue at a wedding reception was $10, in , while a wedding photographer can cost anywhere from $1, to $10, Meanwhile. Want to find a low interest wedding loan? Use our rate comparison tool to check multiple lenders in 2 minutes with no impact on credit. The average cost for a small wedding was $14,, while the average wedding with or more guests cost $38, Venue fees made up about 37% of total wedding. A SoFi Wedding Loan allows you to borrow from $5K to $K with fixed interest rates starting at% APR (with all discounts). You can prepay your wedding loan at any time with no fee or penalty. We've helped more than 3 million customers⁶. Ally, a happy Upstart customer. For Personal Loans, APR ranges from % to % and origination fee ranges from % to % of the loan amount. APRs and origination fees are determined. Wedding loan cost example · Loan amount: $30, · APR: % · Interest rate: 19% · Origination fee: 2% · Origination fee cost: $ · Loan term: 5 years · Monthly. My Wedding Loans provides access to cash loans with fixed rates - starting from % APR - and flexible loan payment terms of up to 5 years. Best wedding loans · Interest rates: % to %. · Loan amounts: $5, to $, · Repayment terms: 2 to 12 years (depending on loan type). · Min. The average cost of the venue at a wedding reception was $10, in , while a wedding photographer can cost anywhere from $1, to $10, Meanwhile. Want to find a low interest wedding loan? Use our rate comparison tool to check multiple lenders in 2 minutes with no impact on credit. The average cost for a small wedding was $14,, while the average wedding with or more guests cost $38, Venue fees made up about 37% of total wedding. A SoFi Wedding Loan allows you to borrow from $5K to $K with fixed interest rates starting at% APR (with all discounts). You can prepay your wedding loan at any time with no fee or penalty. We've helped more than 3 million customers⁶. Ally, a happy Upstart customer. For Personal Loans, APR ranges from % to % and origination fee ranges from % to % of the loan amount. APRs and origination fees are determined.

You can prepay your wedding loan at any time with no fee or penalty. We've helped more than 3 million customers⁶. Ally, a happy Upstart customer. Wedding bells on the horizon, but costs are adding up? Don't let financial stress get in the way of your celebration. Apply for a wedding loan from $1, -. Example interest rate: % p.a.. Comparison rate: % p.a.*. Estimated monthly loan repayments from. $ Total repayment (incl. interest and fees). Verification of income may be required. Offer, rate, and term are subject to change. Membership requires a savings account with a minimum balance of $ Sample. Achieve: Best joint wedding loans · Will keep % - % of your loan as an origination fee · Must borrow at least $5, · Can take up to three business days. The lenders on the uralangar.ru platform offer fixed rates ranging from % – % APR and Variable interest rates from % – % APR. Variable rates. APRs starting at %. Personal loan interest rates typically range between 9% and 36%. The starting rates for Best Egg Personal Loans are on the lower end of. Rates range from % – % APR w/ AutoPay. Example interest rate: % p.a.. Comparison rate: % p.a.*. Estimated monthly loan repayments from. $ Total repayment (incl. interest and fees). Want to find a low interest wedding loan? Use our rate comparison tool to check multiple lenders in 2 minutes with no impact on credit. Loan rates and terms are determined by overall credit history and are subject to change without notice. Applications are subject to credit approval. Monthly. Use our wedding loan calculator to estimate your monthly payment and total interest based on your loan amount, interest rate, and repayment term. Wedding Loans ; Up to 60 Months, % APR ; APR = Annual Percentage Rate. Stated rate is based on certain creditworthiness criteria. Minimum loan amount $ It's worth noting that the advertised interest rate isn't necessarily the one you'll be offered if you're accepted for the loan. Lenders are only required to. The lenders on the uralangar.ru platform offer fixed rates ranging from % – % APR and Variable interest rates from % – % APR. Variable rates. On average, Personal Loans from LendingClub Bank are offered at an APR of % with an origination fee of % and a principal amount of $19, for loans. What is a personal loan? Great question. Personal loans are installment loans with fixed interest rates and fixed monthly payment amounts over a scheduled. A wedding loan is a personal loan you can use to cover the cost of your big day. · Wedding loans may relieve stress, but the debt could add tension between the. How much you get depends on a few factors, including your credit score and your income. Technically, you could borrow enough to cover the cost of your entire. Finance your special day—and the honeymoon—with a personal loan from Customers Bank. Our fixed rates ranging from % to % APR¹ will help you manage.